热门关键词: 五金模具 精密零件 精密零部件 工装夹具

ABOUT

江南app体育登录入口·(中国)官方网站

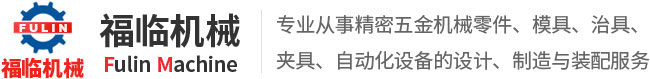

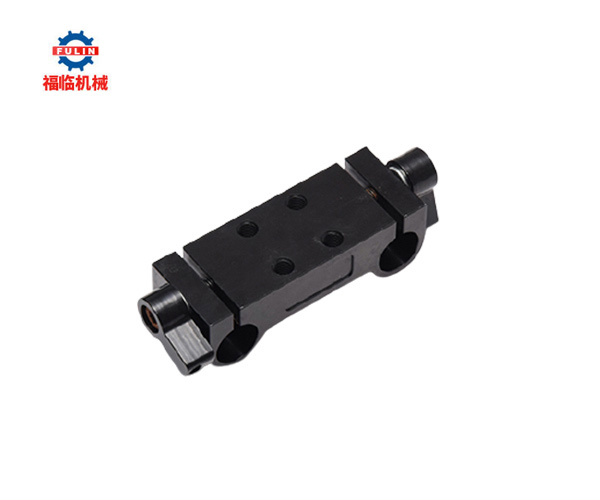

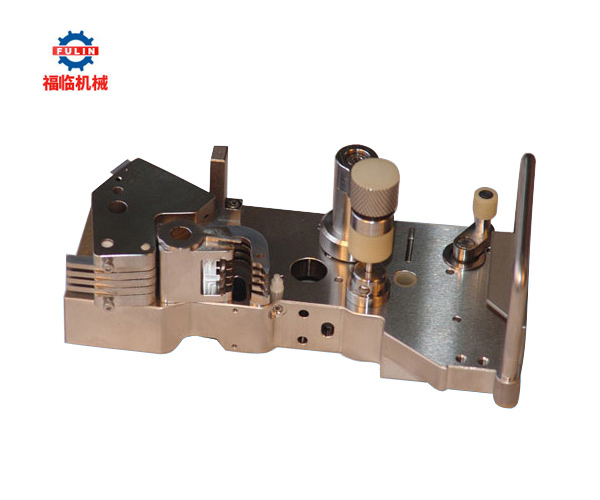

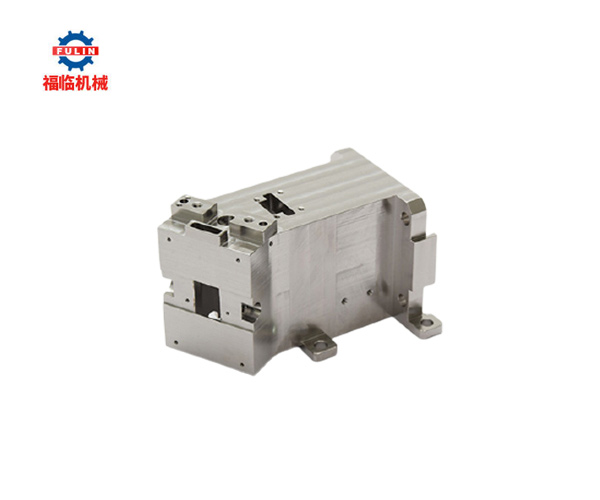

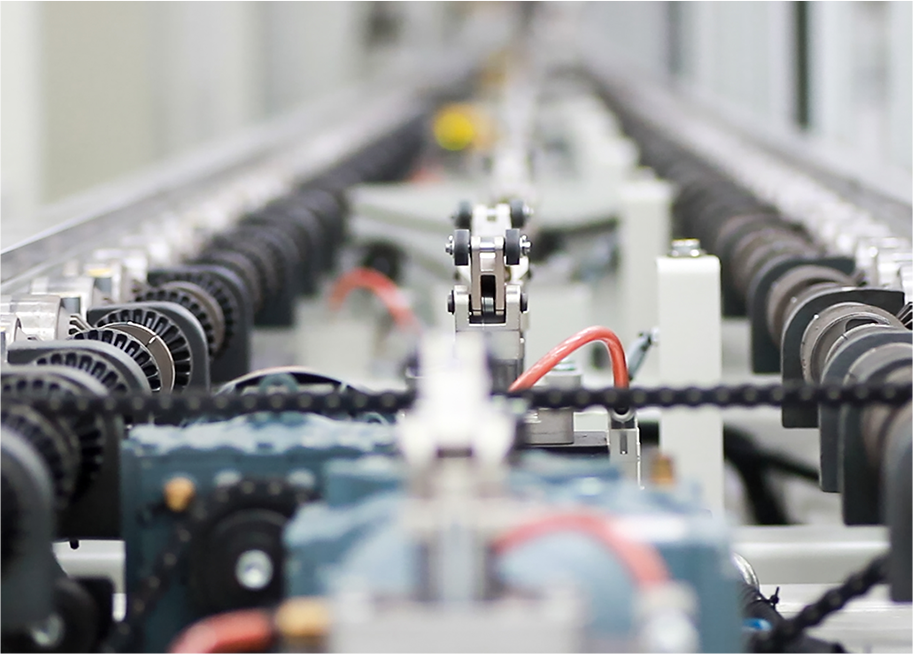

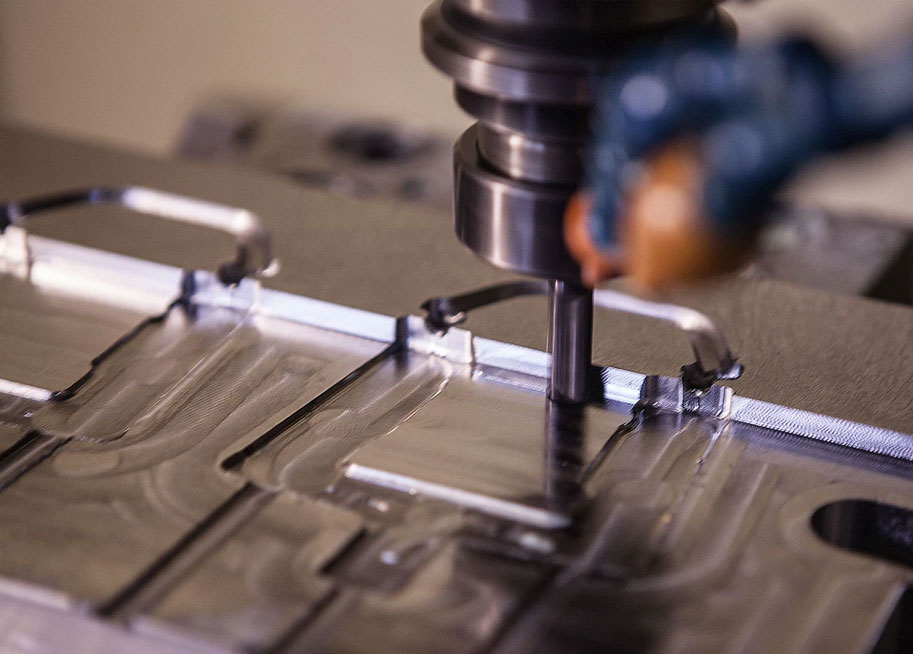

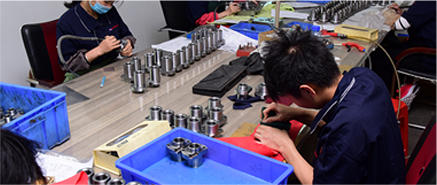

江南app体育登录入口·(中国)官方网站是一家专业从事江南app体育登录入口·(中国)官方网站机械零件、模具、治具、夹具、自动化设备的设计、制造与装配服务的专业性公司,工厂位于中国广东省东莞市万江区思创工业园内,员工180人,其中设计人员18人及高级技师20余人,中级技师80余人。公司产品覆盖机械、电子、半导体、通讯设备、模具、自动化专用生产设备等多种领域,以多品种,高精度,大、中批量非标精密机械零件加工为特色,产品精密度达到0.002毫米,通过ISO、GJB等质量管理体系认证。符合ASME、DIN、JIS等质量管理体系,远销日本,美国,欧洲和中东等地区。公司拥有一流的生产设备,如五轴加工中心、CNC四轴三轴加工中心、车铣复合加工中心、数控车床、高速内圆磨床、慢走丝、车床、铣床、磨床、线切割等,配套先进的检验设备,如三座标、显微镜、投影仪、硬度计、三次元、瑞士高度仪等,满足客户高精度产品的生产加工。

SERVICE ADVANTAGE

福临机械·服务优势

公司产品覆盖机械、电子、半导体、通讯设备、模具、自动化专用生产设备等多种领域

APPLICATION AREA

福临机械·应用领域

公司产品覆盖机械、电子、半导体、通讯设备、模具、自动化专用生产设备等多种领域

NEWS INFORMATION

福临机械·新闻资讯

了解行业资讯,创造资讯价值

福临合作客户/Partner customer

公司秉承“永续经营,合作共赢”之理念,欢迎各位加入合作共赢。

邮箱:fulin@fulinmachine.com / zhaonacity@163.com

电话:0769-23624206 / 0769-23620490 转809

联系人:黎首云 (总经理) 13631712739

传 真:0769-23624207

地址:广东省东莞市万江街道新谷涌工业三路5号2号楼301室

页面版权所有 © 2021 江南app体育登录入口·(中国)官方网站 粤ICP备17040690号